Start early: Begin teaching financial literacy concepts at an early age. Even simple lessons on saving, budgeting, and distinguishing between needs and wants can make a significant impact.

Make it relatable: Connect financial literacy to real-life scenarios that young people can relate to. For instance, use examples of buying their favorite toys or gadgets to explain budgeting and saving.

Interactive learning: Engage youth through interactive activities, games, and simulations. There are various financial literacy apps and online resources designed specifically for young learners.

Budgeting exercises: Encourage youth to create their own budgets based on their allowances or earnings from part-time jobs. This helps them understand the importance of budgeting, saving, giving, and managing their money wisely.

Teach banking basics: Explain how banks work, the importance of savings accounts, and how to use ATMs responsibly. Introduce concepts like interest rates and compound interest to show the benefits of saving.

Encourage entrepreneurship: Foster an entrepreneurial mindset by encouraging youth to start small businesses or take up freelance opportunities. This helps them learn about earnings, expenses, and managing profits.

Set Goals: Help them set short-term and long-term savings goals. Short-term goals could be buying a new gadget or going to a theme park, while long-term goals might include saving for a car or college tuition.

Be Transparent: Share your own experiences with managing your finances. Discuss both successful and not-so-successful decisions you've made and what you learned from them.

Encourage Saving for Big Purchases: If they express interest in a larger item, like a smartphone, gaming console, or a car, help them create a savings plan. This will teach them patience and delayed gratification.

Explore our NextGen Checking Account

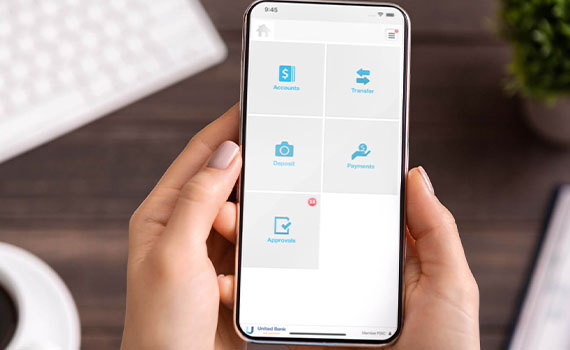

Good financial habits begin with you. Our NextGen Checking Account is designed for teens and young adults ages 14 to 25, giving them the tools to stay in control and build smart money habits. Through our easy-to-use mobile app, you’ll have access to features like card management with spending insights, location-based limits, and the ability to temporarily disable a misplaced card. Plus, enjoy the convenience of mobile check deposit and bill pay—all in one secure, streamlined experience.

We're here for you

Wherever you are on your financial journey, we have experts that are available to help make your dreams a reality. Our team is dedicated to offering the best in customer service, plus, you can call or chat with us anytime, day or night! So, don’t hesitate to give us a call at 616.559.7000 or stop by your local branch.